As a business owner or employee, it’s essential to understand the differences between gross profit and net profit. These terms are often used interchangeably, but they have different meanings and implications for your finances. In this article, we’ll explore the definitions and difference between gross and net, and how they impact your business or personal finances.

What is Gross Revenue?

Gross revenue, also known as gross income or gross sales, is the total revenue earned by a company before any deductions or expenses are taken out. It’s calculated by multiplying the number of units sold by the price per unit. For example, if a company sells 100 products at $10 each, its gross revenue would be $1,000. Gross revenue is an essential metric for measuring a company’s overall performance and growth, but it doesn’t reflect the company’s profitability.

What is the Difference Between Gross and Net Pay?

Gross pay refers to an employee’s total earnings before any deductions or taxes are taken out. It includes base salary, bonuses, commissions, and any other forms of compensation. Net pay, on the other hand, is the amount an employee takes home after all taxes and deductions have been taken out. These deductions include federal and state taxes, Social Security, Medicare, and any employee benefits. The difference between gross and net pay is significant because it can impact an employee’s overall financial situation.

The Pros and Cons of Gross and Net Pay

The main advantage of gross pay is that it provides a clear picture of an employee’s earnings and can be used to negotiate salary and benefits. However, gross pay can be misleading because it doesn’t reflect the amount an employee takes home. Net pay, on the other hand, provides a more accurate picture of an employee’s actual earnings, but it may not be as useful for negotiating salary and benefits.

Gross vs Net: What’s the Real Cost of Employee Benefits?

Employee benefits are an essential part of compensation packages, but they can be costly for employers. The cost of benefits can impact both gross and net pay. For example, if an employer offers health insurance, the cost of the premium will be deducted from an employee’s gross pay, reducing their net pay. On the other hand, the cost of benefits is tax-deductible for employers, reducing their taxable income. Employers need to weigh the cost and benefits of offering employee benefits to determine what works best for their business and employees.

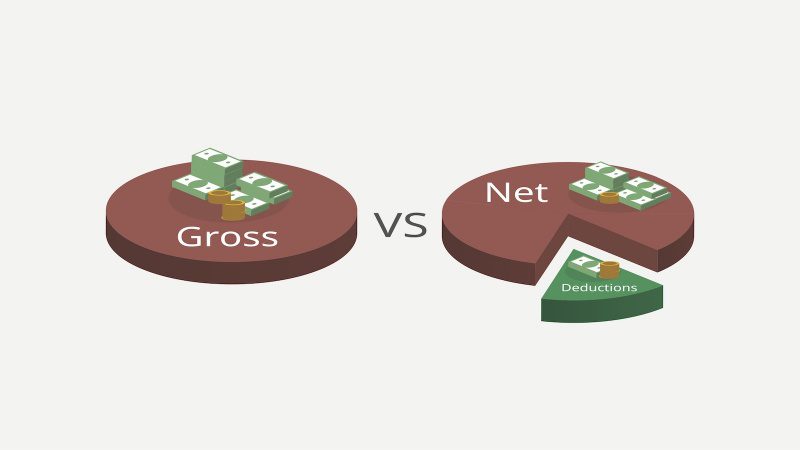

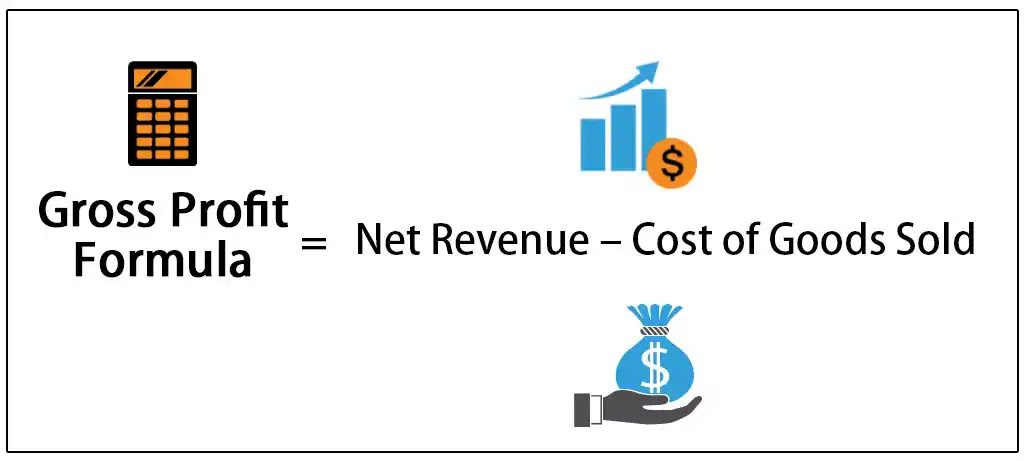

Net Profit vs Gross Profit

Gross profit refers to the total revenue earned by a company minus the cost of goods sold. It’s a measure of how much money a company makes from selling its products or services. Net profit, on the other hand, is the total revenue earned by a company minus all expenses, including operating expenses, taxes, and interest. Net profit is a more accurate measure of a company’s profitability because it takes all expenses into account.

Gross Profit vs Gross Margin

Gross profit and gross margin are often used interchangeably, but they have different meanings. Gross profit is the total revenue earned by a company minus the cost of goods sold, while gross margin is the percentage of revenue that remains after deducting the cost of goods sold. Gross margin is a measure of a company’s profitability and is calculated by dividing gross profit by total revenue. It’s an essential metric for measuring a company’s financial health and can help identify areas for improvement.

Conclusion

Understanding the differences between gross profit and net profit is crucial for managing your finances, whether you’re a business owner or employee. Gross revenue, gross pay, and gross profit are all important metrics for measuring performance and growth, but they don’t tell the whole story. Net pay and net profit provide a more accurate picture of your actual earnings and profitability.